What Is the Cryptocurrency Market and Why Does It Exist

The cryptocurrency market is a global space where digital money is traded. Unlike traditional currencies printed by governments, these assets are created through blockchain technology — a kind of public digital ledger where every transaction is visible and cannot be erased.

Unlike banks or governments that control traditional finance, cryptocurrencies operate in a decentralized system. They can be sent directly from person to person, without intermediaries, and transactions are verified by thousands of computers worldwide. This gives people a sense of freedom and independence — the reason millions are drawn to crypto.

But freedom comes with chaos. There are no guarantees or safety nets. Prices can swing by double digits in a single day. That’s why the crypto market is both a place of quick fortunes and sudden losses.

Market Cycles and Key Events

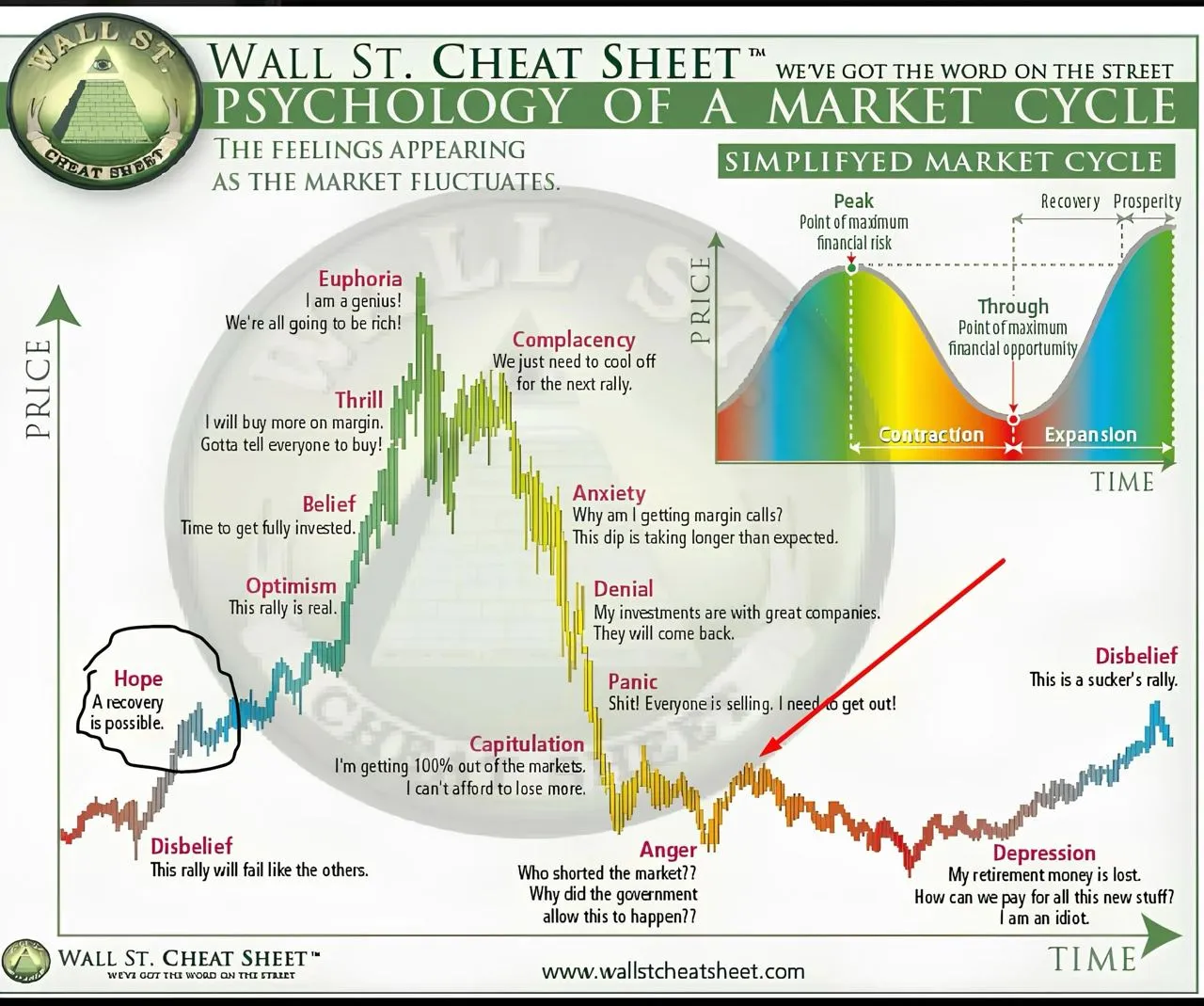

The crypto market moves in cycles — much like the seasons. After every “winter” of decline comes a “spring” of growth.

A typical cycle starts with accumulation: prices stay flat, while large investors (the so-called “whales”) quietly buy. Then comes the bull run — prices soar, headlines shout about new millionaires, and the crowd rushes in. Eventually, euphoria turns into panic: people take profits, the market crashes, and those who entered late are left with losses.

After a period of stabilization, the market starts over. These cycles have repeated many times — from Bitcoin’s meteoric rise in 2017 to the crash in 2018, and from the DeFi and NFT boom in 2021 to the long “bear market” that followed. Each phase brings new winners, new losers, and new lessons.

Futures Trading: For the Brave and the Cautious

Futures trading is one of the riskiest yet most thrilling parts of the crypto world. Think of it like a bet: you agree today that Bitcoin will cost more in a week. If you’re right — you profit; if not — you lose.

Futures allow traders to earn on both price rises and drops. Leverage lets you borrow funds from the exchange to increase your position size. For example, with $100 and a 10x leverage, you can open a $1,000 trade. But if the market turns against you, you don’t lose 10% — you lose everything.

When prices move sharply, exchanges automatically close losing positions — this is called liquidation. The more traders use leverage, the more dangerous the market becomes: one sudden move can wipe out thousands of accounts in seconds.

The Black Day of Crypto: October 10, 2025

October 10, 2025, became one of the darkest days in crypto history. That day, Donald Trump announced 100% tariffs on Chinese tech exports. Within hours, panic swept global markets — and crypto was hit the hardest.

In just 24 hours, over $19 billion worth of leveraged positions were liquidated. More than 1.5 million traders lost their entire balance. Bitcoin plunged from $125,000 to around $105,000 — even lower on some exchanges.

For many, it was a shock. People confident in a rally watched their accounts go to zero within minutes. Analysts called it a “digital hurricane” that wiped out the masses and enriched a few.

But it wasn’t random. Politics, big funds, and “whales” were all part of the storm. Those with information acted faster, while retail traders were left in the dust. To outsiders, it looked like chaos — in reality, it was a calculated game.

Manipulation, Emotion, and the Power of the Crowd

The crypto market isn’t a fair playground. It’s an arena dominated by giants. Big players with billions can move prices by creating illusions of demand or fear.

A single large sell order can trigger a wave of panic among small traders, forcing them to close positions. Then, “whales” buy the same assets at a discount. This strategy — “stop hunting” — is as old as trading itself.

Psychologists studying financial behavior note that most traders act emotionally, not rationally. Fear, greed, and FOMO (fear of missing out) drive decisions. Whales understand this perfectly — using social media, rumors, and fake “analyst leaks” to steer retail investors in the direction they want.

How to Stay Safe and Protect Your Capital

Rule one: never trade without rules. Leverage is not a gift — it’s a trap. If you’re a beginner, avoid borrowed funds entirely. Smaller profits are better than total losses.

Rule two: diversify. Never put all your money in one coin, no matter how promising it seems. Spread it across different assets, keep some in stablecoins or even outside the crypto market.

Rule three: discipline. Don’t chase hype or follow random tips online. Before any trade, ask yourself: “If this drops 30%, will I still sleep at night?” If not — the risk is too big.

And finally, master your emotions. Calmness is your biggest advantage. On this market, survival belongs to those who stay rational when everyone else panics.

The Future of Crypto

The future of cryptocurrency depends on technology, regulation, and human behavior. Blockchain is evolving, DeFi is expanding, and governments are crafting new laws to protect investors.

Crypto is maturing. Once a playground for enthusiasts, it’s now attracting banks, funds, and even nations. That brings more stability — and fewer explosions.

But human nature remains unchanged. Fear and greed will continue to move prices. The key is to understand the waves — and learn to ride them instead of drowning.

Conclusion

The crypto market mirrors our time: unpredictable, emotional, and full of opportunity. The crash of October 10, 2025, showed how one day can erase billions — yet open new doors for those prepared.

You can’t eliminate risk, but you can manage it. And those who see order in the chaos will find their chance in the financial future that’s unfolding right before us.